Posts Tagged ‘Startup Capital’

Startup Business Planning and Capital Raising

So you have finally decided to get serious about that business idea that has been developing in your mind over the past few months. Congratulations. Taking action and overcoming inertia is a huge first step. Most ideas never get this far. Let’s discuss your next steps.

We offer the following services to help you accomplish each goal:

Feasibility Study For Small Business

Your first step is to conduct a feasibility study. The purpose of a feasibility study is to determine the viability of a new business. A feasibility study is compilation of exhaustive market research. It is best to start with Internet research then move on to trade organizations and publications. Then you should talk to people who are already in the industry – competitors, customers, suppliers, investors, etc. If you haven’t yet, call them. You will be surprised at how much they are willing to talk about their businesses. You will often discover how to tweak your business model to better address industry’s pain points. We have helped entrepreneurs with dozens of feasibility studies.

Business Plan Development

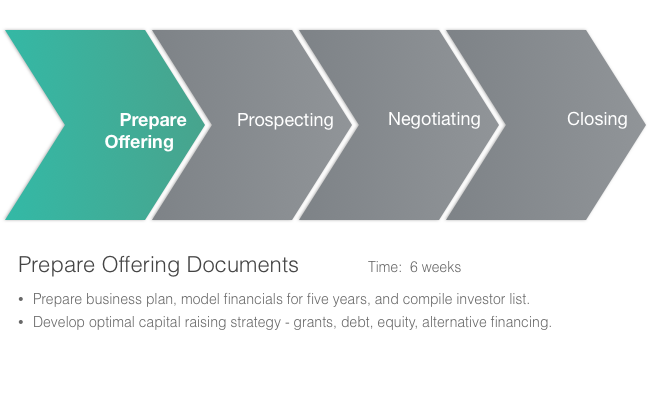

Once you have determined that your business is potentially viable you need to write a business plan. Business plans are used to raise startup capital, annual planning and budgeting, to sharpen operational focus, and to collaborate with partners or employees. Educate your self about how to write a business plan. Make a good financial model that can be used as a capital and operating budget. Writing a good business plan is an art not a science. We have written many, many business plans for companies in numerous industries and would be delighted to help with yours.

Raising Funding for Small Business

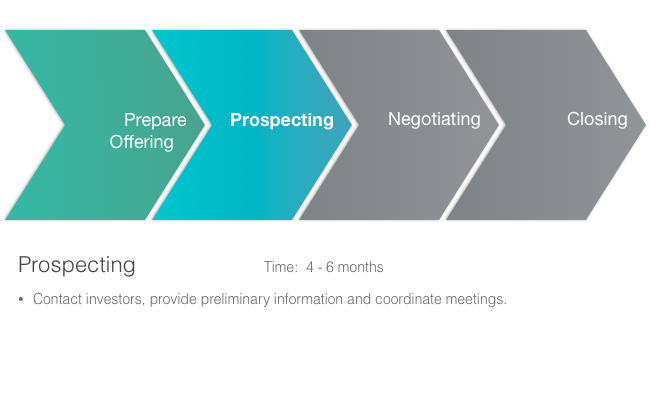

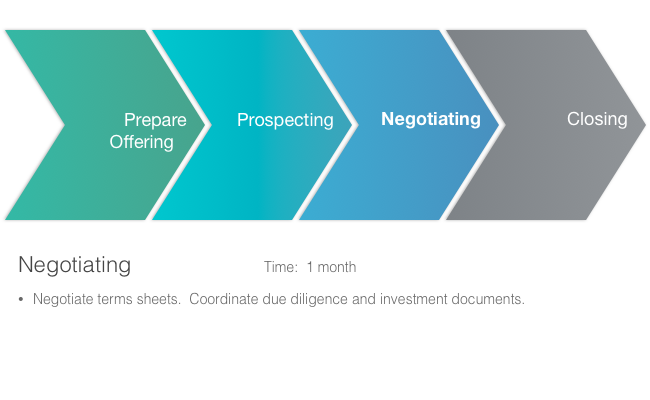

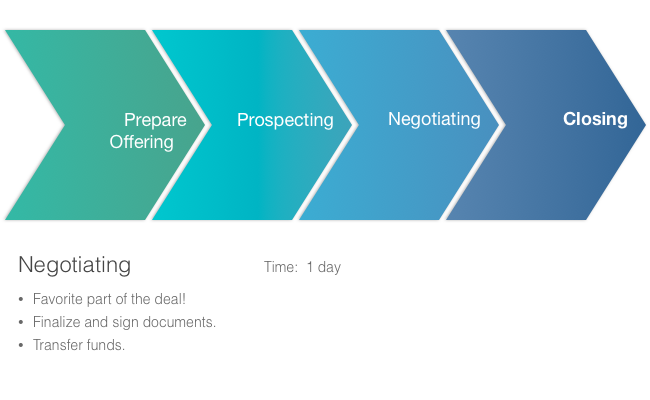

Once you have a business plan you should figure out a capital acquisition plan. The first money for the company will probably come from you personally – savings, credit cards, etc. Next you will need some seed money to get off the ground. Best bet is to ask family and friends. Look into crowdsourcing sites like Kickstarter. Afterward, maybe you can approach angel investors to fund you. Also, don’t forget unconventional sources of capital – your vendors may be willing to extend you credit. Your customers may be willing to prepay for some products. Now is the time to be scrappy. We have sold or raised more than $220M of capital for companies just like yours and we would like to help you raise the capital you need to allow your business to succeed.

Small Business Financial Consulting

In our experience, the vast majority of small businesses do not have high-level financial talent in-house. And frankly, most startups do not need a high-priced full time finance professional. However, all businesses need someone watching the books. We have served as Acting CFO for several of our clients over the years. We can work on an hourly or retainer basis and do analysis and banking work as needed.

Read More → Comments Off on Startup Business Planning and Capital Raising

Investors: Seeking To Fund Small Business & Green Tech Companies?

Are you an investor looking to fund a high potential business? That is fantastic. Please fill out our questionnaire with your contact information and your investment criteria. We have a strict policy not to send investment opportunities that are not suited to the investor. So please, keep your criteria as broad as possible so that you will not miss any good opportunities. We screen for location, industry, and size of deal.

Are you interested in investing in a green business? Excellent. We want to talk with you. There are many green or otherwise socially proactive businesses out there that need funding. We are a small firm and we only take on clients who we can raise money for. We aggressively filter our clients. Rest assured, all of our clients have been thoroughly vetted and we have done our due diligence.

We are happy to answer any questions you may have and if we do not have the answers we are happy to get them for you. However, all of the information we have is from the clients and we cannot vouch for their accuracy, etc. You know the drill.

Give us a call at (213) 537-3580 or contact us to discuss all of our opportunities with green tech companies, small business investment opportunities, and protecting your investment before, during, and post-sale.

Read More → Comments Off on Investors: Seeking To Fund Small Business & Green Tech Companies?

Green Financial Consulting and Investment Banking

Ampure Capital LLC is a small business financial consulting and boutique investment banking firm deeply committed to unleashing entrepreneurial drive and free market capitalism to surmount environmental and social problems in the world today. Our mission is to enable entrepreneurs, especially socially and environmentally proactive entrepreneurs, to succeed at all stages of business growth from conception to maturity to exit. We work with companies in all industries, but love clients that are trying to make our world a better place.

Read More → Comments Off on Green Financial Consulting and Investment Banking

Raising Capital for Your Startup Business

Most entrepreneurs come to us for help raising capital. Many want venture capital and we can certainly help raising money from VCs. However, 99% of companies are not a good fit with VCs. Venture capital is expensive and very difficult to get. Venture capitalists look for home runs – companies that will return ten times their money within 5 or less years. They will push you to take risks and spend money. They are not necessarily looking out for what is best for the business or the entrepreneur. Most entrepreneurs have a company that will earn them a comfortable return but that may not be the grand slam that VCs are looking for. The good news is that VCs are not the only source of capital.

So how do you raise the capital you need for your business?

Raising Startup Capital and Seed Capital

First, you need to raise startup capital to determine if your idea has “legs.” Your best bet is to use your personal assets. Also consider crowd funding sites like Kickstarter or RocketHub. They are good for raising capital of $5k to $25k to determine if you business is viable. Once you have established viability, consider applying for grants. Next, look to friends and family to raise capital of $50k to $200k. Many entrepreneurs raise this seed capital via convertible debt. If you don’t have paying customers after spending $200k you should consider whether you should be raising capital or whether you should be working on your value proposition. It is vital that your business achieve market traction in this phase. With professional investors, you will get better terms and have better results the further along the path to profitability you are.

Once you are up and running, don’t forget unconventional sources of capital – your vendors may be willing to extend you credit. Your customers may be willing to prepay for some products. Lease equipment instead of buying out right. Borrow or barter for equipment and office space. Call in favors.

Once you have an operating business, you can look to the SBA or bank for a loan or line of credit. Maybe you should establish a relationship with a factor in case you need to sell some receivables quickly. Maybe venture debt is a good choice for you. There are many, many sources of capital that most entrepreneurs just do not consider.

Plan to Raise Capital

Professional investors are just one way to raise capital. You need to have a financing plan for your business – raising equity, raising debt, and raising grant capital. Remember the old saying – everyone wants to give you money when you don’t need it and they are nowhere to be found when you do. Raising money has become a continuous process and not a discrete fund raising event. As we all know, running out of money is the primary reason that small businesses fail. If you plan well at the beginning you will not run out of money.

We have sold or raised more than $220M of capital for companies just like yours and we would like to help you develop a capital acquisition strategy and to raise the capital you need to allow your business to succeed.

To learn more about how Ampure Capital can help you raise the startup capital you need to get your business off the ground please fill out the contact form and or call us at (213) 537-3580.

Read More → Comments Off on Raising Capital for Your Startup Business