Posts Tagged ‘Prepare Your Business For Sale’

Services For Business Owners

Ampure Capital understands how difficult it can be to raise venture capital and angel capital in today’s markets. We also understand how difficult it can be to run your business, maximize the value of your business, and to sell your business. No matter your current business situation, Ampure Capital can help you achieve your goals.

Small Business Financial Consulting

In our experience, the vast majority of small businesses do not have high-level financial talent in-house. And frankly, most startups do not need a high priced full time finance professional. However, all businesses need someone watching the books. We have served as Acting CFO for several of our clients over the years. We can work on an hourly or retainer basis and do analysis and banking work as needed. We can also help you develop an annual strategic plan.

Raising Capital

You need to have a financing plan for your business – raising equity, raising debt, and raising grant capital. Remember the old saw — everyone wants to give you money when you don’t need it and they are nowhere to be found when you do. Raising money has become a continuous process and not a discrete fund raising event. If you plan well at the beginning you will not run out of money. As we all know, running out of money is the primary reasons that small businesses fail. Once you have an operating business, you can look to the SBA or bank for a loan or line of credit. Maybe you should establish a relationship with a factor in case you need to sell some receivables quickly. Maybe venture debt is a good choice for you. Have you applied for all the grant available to you? Let’s talk about how we can finance your business.

Strategic Business Planning

Ideally, every year you should assess the competitive landscape and plan how to get to where you want your business to be in one, five, and even more years in the future. If you are like most small business owners you probably have not done this formally for many years, if ever. To learn more about how Ampure Capital can help you with your strategic business planning please fill out the contact form and or call us at (213) 537-3580.

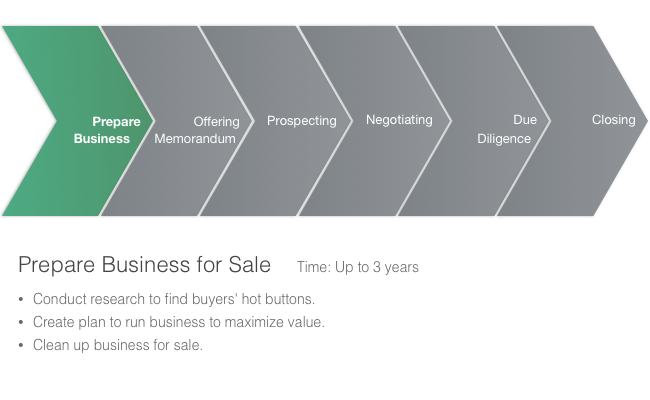

Preparing Your Business for Sale

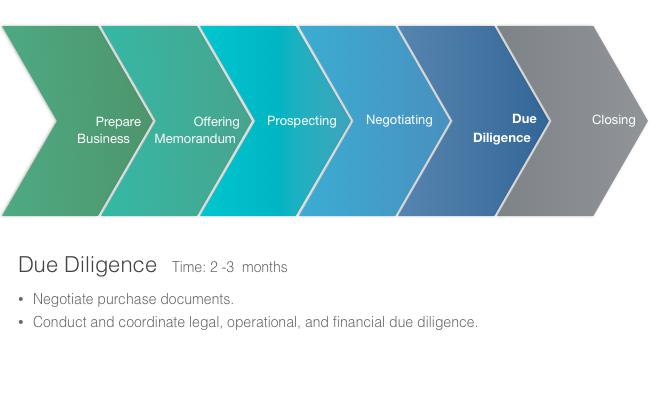

If you start today, it will take you three to five years to sell your business and be completely out. If you plan to retire in the next five to ten years, you should start preparing your business for a sale today. Preparing your business for sale involves two main components — maximizing the value of your business and ‘cleaning up the business’ thereby removing any obstacles to getting a deal done. There are a million things that a potential buyer looks for in a potential acquisition target. We have helped prepare dozens of businesses for sale and have a very good idea what buyers are looking for.

Selling Your Company

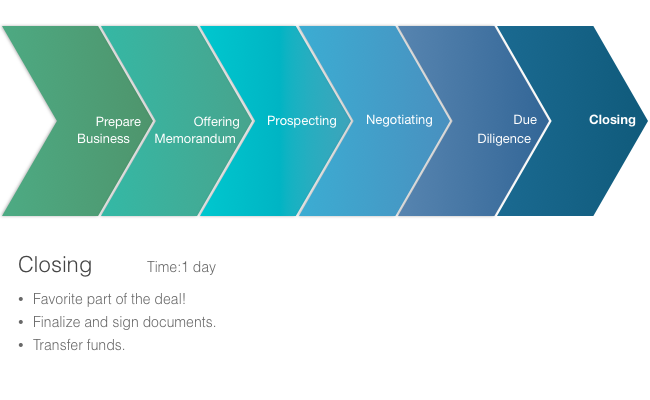

Ampure Capital can help guide you through the process of selling your company. We can let you know what is happening in your industry and the larger economy and M&A market. We can help you devise a plan to maximize the value of your business. And we can run an efficient selling process and bring the right buyers to the table and facilitate the best deal for you. Selling small businesses is our core strength.

Read More → Comments Off on Services For Business Owners

Sell Your Company

Making the decision to develop an exit strategy to sell your company is very personal. Your company provided for your family, paid for your vacations, put your kids through college, and, with a proper exit strategy, should provide a comfortable retirement. Your business, after your children, may be your life’s greatest accomplishment. And also lets face it, it has been a lot of work – you have been the “chief cook and bottle washer,” you put in long hours, worried about losing your big client, stressed about making payroll, sweated hiring and firing personnel, etc. especially during the startup years. Now you are considering an exit strategy to sell your company. This may be the most important financial decision you will ever make in your lifetime. What should you consider?

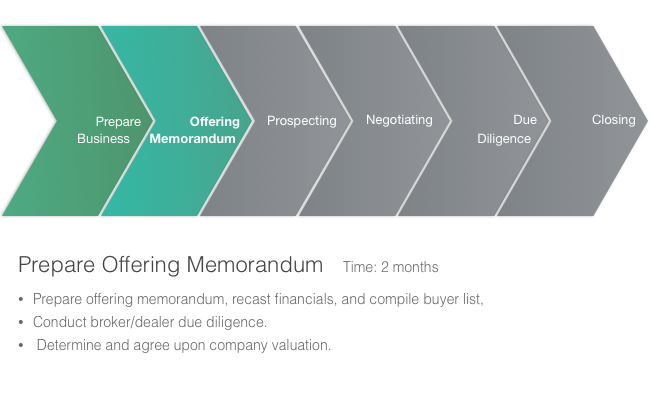

Do You Hire a Banker?

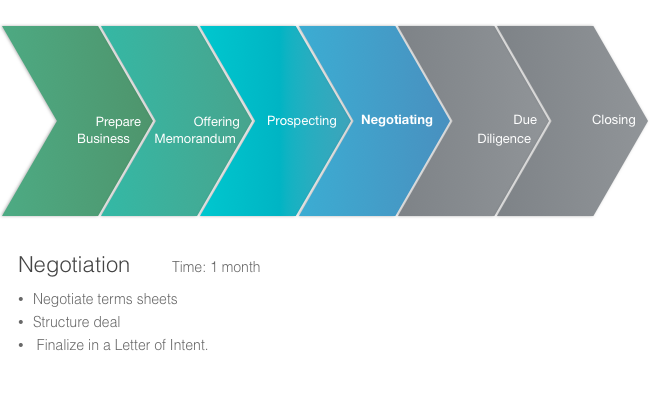

Deciding whether or not to hire a banker or business broker to sell your company for you is an important first step. Hiring someone will allow you to run you business without the distractions of contacting, educating, and managing numerous potential buyers. A banker or business broker should know what buyers in your industry are looking for and who they are. They also should be able to tell you know what they think your business will sell for, given a little research. A banker should be able to bring several interested parties to the table and via a “limited auction process” be able to maximize value in a way that you will not be able to if you decide to sell your company on your own. Also remember that the buyer will be your employer for a couple of years – it is not in your best interest to play hardball with him. Let the banker be the bad guy. If a banker cannot increase the price of the business more than his/her fee, he/she will not be in business for long.

Another issue to consider in hiring a banker or business broker to sell your business is that the buyer will often be in the business of buying businesses professionally. You will likely sell one, maybe two, businesses in your lifetime. The person sitting on the other side of the table from you may do 5+ deals a year. You need to have someone on your side who knows the ins and outs of doing deals. There are a lot of pitfalls in selling a business. Having a good experienced guide should not to be taken lightly.

Finding the right buyers is not as obvious as it may seem. Often your competitor down the street is not the right buyer. A good banker will research the industry and find the right companies to approach – maybe local, maybe a private investment firm, maybe an overseas buyer looking to get into the domestic market, or maybe someone in a completely different industry but with some need to get into your market.

Exit Strategy with Ampure Capital

Ampure Capital can help guide you through the process of selling your company. Of course, we cannot tell you when is the best time for you to sell your business. However, we can let you know what is happening in your industry and the larger economy and M&A market. We can help you develop a plan to maximize the value of your business. And we can run an efficient process and bring the right buyers to the table and facilitate the best deal for you. To learn more about how Ampure Capital can help you sell your company please fill out the contact form or call us now at (213) 537-3580.

Prepare Your Business for Sale

Do you want to spend more time on the golf course? Or with the kids or grandkids? Maybe you just want to cut back on your hours? Or maybe you have a different idea that you want to pursue? Now is the time to start preparing your business for a sale.

Most potential buyers will want to see 3 years of historic financials/tax returns. This means that if you want to sell as soon as you can and the business hasn’t been performing as well as you know it can, you need to spend two years improving the financial performance before presenting it to potential buyers. Selling a business is a complicated process that usually takes at least a year from start to finish. In addition, most buyers will want you to be involved for a period of time after the sale. They will typically ask for 2 years.

From the time you start to look for a business exit strategy to actually walking away will likely take you 3 to 5 years including preparing the business for sale, selling the company, and transitioning the business to a new buyer. If you are getting burned out, now is the time to start.

Preparing your business for sale involves two main components – maximizing the value of your business and “cleaning up the business,” or removing any obstacles to getting a deal done.

How Do You Value a Company for Sale?

Buyers look for different things in a business but at the end of the day they are looking for earnings and cash flow. Maximizing value of your business can be summed up simply as maximize both short-term and long-term profitability and cash flow. Some things investors look for are:

- Strong Revenue Growth (10%+)

- The “quality” of the revenue – Is it recurring? Do you have long term contracts in place with customers? Do you have significant repeat business? Or is your revenue “lumpy,” or project based?

- Customer Concentration – Do you have one large customer? Any customer that accounts for more than 10% of revenue is a red flag. Any that accounts for more than 20% is a serious cause for concern. More than 30% is likely a deal breaker.

- Do you have a backlog with preorders, purchase orders, etc.

- Are your gross and net margins growing or shrinking? Why?

It is vital to develop a plan to get from where you are to where you want to be. We understand that strategic planning often falls into the “important but not urgent” category and therefore is often left undone. Hiring us will take much of the burden off of you and and allow you to run the business.

Cleaning Up Your Business

In order to prepare your business for sale you also need to clean up the business. Some things to consider are:

- Do you have a good management team in place that can run the business when you are not there? What would happen if you were gone for a month?

- Are you the primary contact with customers and vendors? Can you transition the relationships?

- Is the company completely separate from your personal life? Does your company pay for your and your spouse’s car lease, country club dues, phones, vacations, etc.?

- Does the company own the real estate or is it owned by a separate LLC?

- What does your cap table look like? That is, is the ownership clean or do you have a bunch of small investors, or convertible debt, etc. Try cleaning it up.

- Have you looked at your most recent D&B report, online reviews, etc?

- Have you kept track of your inventory properly? Has it been verified by an outside party?

- Do you have all your contracts signed and in good order?

- How are your accounting systems? Are your financials compiled? Consider getting your books reviewed if not audited.

- Make sure that all of your trademarks are registered, everything you can patent is patented, etc.

- There are many more things – are you in compliance with all licenses, software, etc? Have you been keeping board meetings minutes? Etc., etc.

There are a million things that a potential buyer looks for in a potential acquisition target. Do you know what they are? We do. Do you have a plan to get there? We have helped prepare dozens of businesses for sale and have a very good idea what buyers are looking for.

To learn more about how Ampure Capital can help prepare your business for sale please fill out the contact form or call (213) 537-3580.

Read More → Comments Off on Prepare Your Business for Sale